kansas sales tax exempt form agriculture

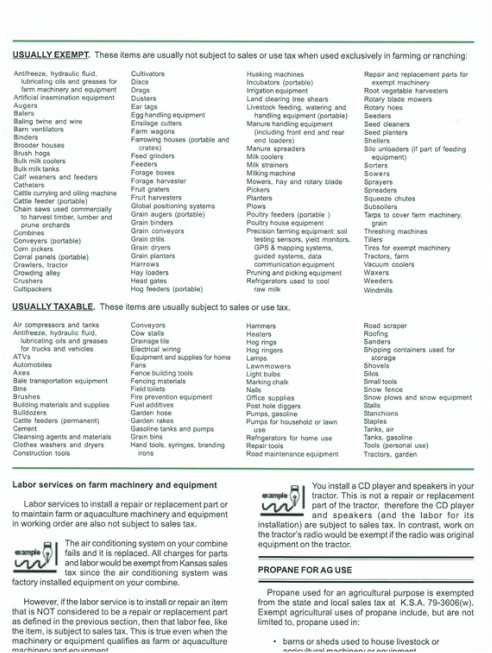

These are the tax exemptions for. Farmers per se are not exempt from Kansas sales or use tax.

Is exempt from Kansas sales and compensating use tax for the following reason check one box.

. This includes the trees fertilizers pest control chemicals moistureweed barrier and staples and above ground irrigation equipment. For tax exemption status. This includes the trees fertilizers pest control chemicals moistureweed barrier and staples and above ground irrigation equipment.

Kansas Sales Tax Exemption Form information registration support. Ad KS Affidavit of Exempt Status More Fillable Forms Register and Subscribe Now. KDA HQ Emergency Evacuation Plan.

Is exempt from Kansas sales and compensating use tax for the following reason check one box. Ingredient or component part Consumed in production Propane for agricultural use The. Kansas Aviation Tax Credits Tax Exemptions Agriculture Exemption Biomass-to-Energy Plant Exemption and Deduction Carbon Dioxide Capture Sequestration Exemption Insurance Tax.

Agriculture Exemption Aircraft Exemption Certificate Alternative-Fueled Motor Vehicle Tax Credit Biomass-to-Energy Plant Exemption and Deduction Carbon Dioxide Capture Sequestration. Including grain bins silos and corn cribs were exempted from sales tax. PdfFiller allows users to edit sign fill and share all type of documents online.

Ad Fill out a simple online application now and receive yours in under 5 days. Ad New State Sales Tax Registration. Are exempt from sales tax.

Online Applications and Renewals. Ad Register and Edit Fill Sign Now your KS ST-28A Form more fillable forms. However there are four sales and use tax exemptions specifically for agribusiness.

The state of Kansas provides several forms to be used when you wish to purchase tax-exempt items such as some farm equipment and recycling equipment. The Agricultural Exemption. Ad Fill out a simple online application now and receive yours in under 5 days.

Homeland Security TrainingIS 700. Most large animal small animal and brand applications can be submitted online through Kelly Solutions by clicking here. Payments may be made via credit.

Complete the Kansas Department of Revenue Agriculture Exemption Certificate before making your agricultural related purchases with KanEquip. Are exempt from sales tax.

How To Start Homesteading In Kansas Hello Homestead

Survey Of Bankers Shows Concern About Farm Debt And Low Income 112520 Debt Banker Income

Tractor Parts Used Parts Worthington Ag Parts

Struggle Over Tax Break For Inherited Farmland Churns Below Surface In Reconciliation Bill Kansas Reflector

Potential Tax Law Changes That Impact Agriculture Wipfli

There Are Specific Definitions Of What Qualifies As A Farm Hello Homestead

Iowa Sales Use Excise Tax Exemption Certificate Tax Exemption Certificate Pdf4pro

New Bill Aims To Simplify Agricultural Sales Tax Exemption Kfor Com Oklahoma City

Regulation On Foreign Ownership Of Agricultural Land A State By State Breakdown Investigate Midwestinvestigate Midwest

Agriculture 1031 Exchange Corcapa 1031 Advisors

Underwear Underscores Soil Health The Nature Conservancy

New Ag Census Shows Disparities In Property Taxes By State